5 Payment-Free Trading and investing & Investing

Казино Пинко должностной сайт Pinco Casino, зеркало, зарегистрирование а также вербное

13/09/2025Better On Lobstermania online free slot machine the internet Pokies in australia for real Money 2025

13/09/20255 Payment-Free Trading and investing & Investing

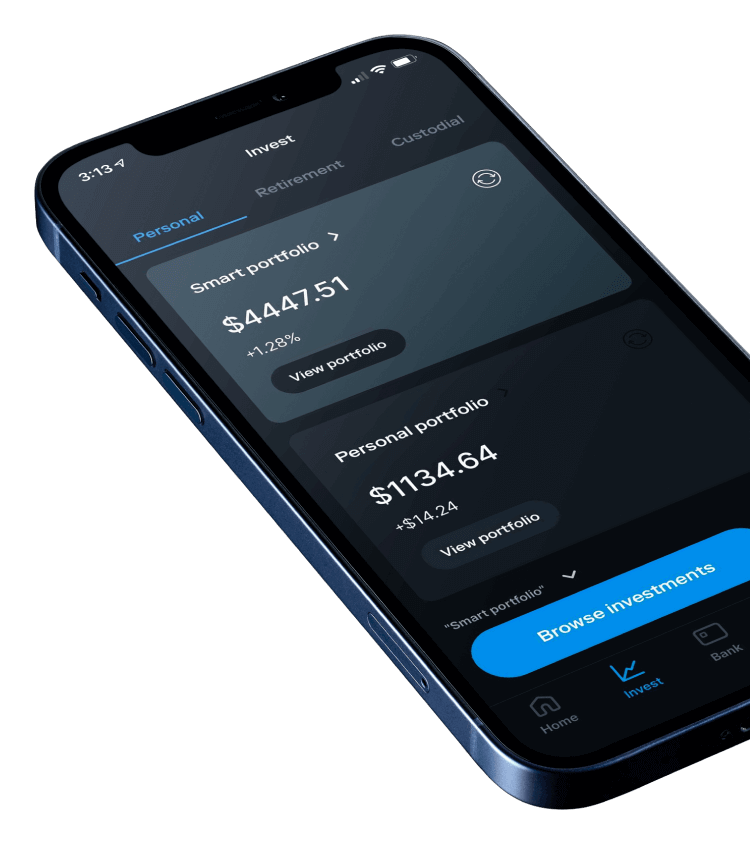

But if you meet with the above lowest conditions, award outstanding customer support, price and savings, Cobra Trade will be worth investigating to suit your active change demands. The new user interface continues to be greatly aimed toward young, shorter experienced buyers—everything is concerned about convenience and you will simpleness, instead of an enthusiastic expanse out of excellent products. SoFi also provides funds-friendly has such fractional offers, that allow you to invest for as little as $step one. And you may SoFi actually brings a personal ability, including getting SoFi players together with her from the private situations. To take action, of many brokerages provides changed what they are selling way of focus on doing a regular experience across several gizmos. It means you could potentially usually come across similar workflows and secret systems regardless of and that platform you’re on.

The risks of Meme Brings

- The newest cellular app decorative mirrors the new pc experience, which have actual-day connect round the programs.

- Webull is the greatest for individuals who’lso are a professional investor looking for an effective mobile platform.

- Although we have talked about a knowledgeable trading programs active in the the area, it is vital that your do some research of one’s.

- You need to be able to get a trading app with zero commission charges, low costs percentages and plenty of money vehicle on how to create your profit industry.

How much money you dedicate at the start doesn’t always correlate to how much cash you’ll provides subsequently. So, you might also not have restrictions at the start having a merchant account lowest. The service does not fees beginning, closure or annual membership costs. If you’d like to add on an enrollment to help you Nasdaq TotalView immediately after the first 3 months, you might to possess an affordable $1.99/mo commission. Because you make a better understanding of the market, you’ll want to expand your using arrived at for the the new parts and you can find out if other spending appearance suit your needs. Some stock updates may even have to practice a far more productive form of exchange and have vetted stock alerts sent to its mobile phones for taking advantage of industry movements.

Actually, the majority of best stock agents wear’t costs one commissions at all. Your normally have no-account minimum to start investing from the mobile phone. In the wonderful world of trade apps, pair have as numerous accolades and you will a strong reputation because the TD Ameritrade’s thinkorswim. The platform has no real weak points—the shape is quite enticing and you can easy to use, which is perfect for beginners, but the application is also laden with provides that will meet any specialist buyer’s requirements. The brand new margin rates with a normal membership is 9.75%, which is high, although not, this can be lowered so you can 5.75% by the updating in order to an excellent RH Gold account. The newest Silver membership as well as gives pages an excellent 3% return to the the lazy bucks, along with bigger immediate deposits and more field investigation provide.

His functions provides appeared in big books such Kiplinger, MarketWatch, MSN, TurboTax, Nasdaq, Bing! Money, The planet and you can Send, and CNBC’s Acorns. But with fractional https://www.mundopetreo.com/5-percentage-100-percent-free-trading-and-investing-investing/ offers, you might usually dedicate only $one in each individual team, letting you give your bank account around many different organizations. That is titled “diversification” helping include you against a decline in almost any unmarried stock.

How to start off With Paying Applications

Webull offers a mobile and you may desktop computer platform and a surprisingly thorough research equipment system for being a somewhat the new spending software. You should buy fractional shares of inventory equities and you may ETFs that have an excellent $5 harmony throughout the normal and lengthened business instances. You may also trading ADRs (foreign companies exchange to your most other stock segments), choices, and crypto futures.

As opposed to other agents you to counterbalance no-payment investments which have large charge someplace else, IBKR Lite provides zero-commission deals for U.S. carries and you may ETFs no monthly costs otherwise account minimums. Which available approach lets private traders first off building the profiles as opposed to initial will set you back, and then make IBKR Lite an appealing selection for funds-conscious people. And you will, that have IBKR’s wide variety of tradable property across worldwide places, investors can also be broaden its profiles without having to worry regarding the hidden charges one to can add up throughout the years.

Treasurys and you may fractional shares of holds, so it is available to traders searching for repaired-income or on the tighter finances. They features a social networking-for example program where you can pursue most other traders and find out the holdings. You may also search through thematically connected stocks to get information and then score type in from other buyers.

You could potentially unlock a home-brought Energetic Investing and Automatic Spending membership. The brand new financing choices are carries and ETFs which have a $5 minimal funding. M1 Fund is a wonderful solution if you wish to thinking-manage your account and you can availability handled money one almost every other networks charges a consultative fee to own. Expertly managed portfolios come with resource allocations anywhere between traditional to help you competitive.

If you want to dedicate but never should actively create a profile, an app out of a good robo-advisor for example Betterment will make probably the most experience. Webull profiles appreciate their abilities for possibilities and you may charting, the newest commission-totally free trade construction, plus the detailed educational information it has to possess people. Broker services for us noted ties, choices and you may ties in the a personal-directed broker account are offered by the Available to anyone Using, member FINRA & SIPC. You get access to multiple investment to the globe-simple zero commission to have inventory and you can ETF deals along with the lowest 50-cent percentage to own options agreements. Webull is best for active buyers who need a strong inventory app without fees, complex charting equipment and you can margin spending.